At Mining Indaba, Rawbank confirms its role as leading banker to the Congolese mining industry

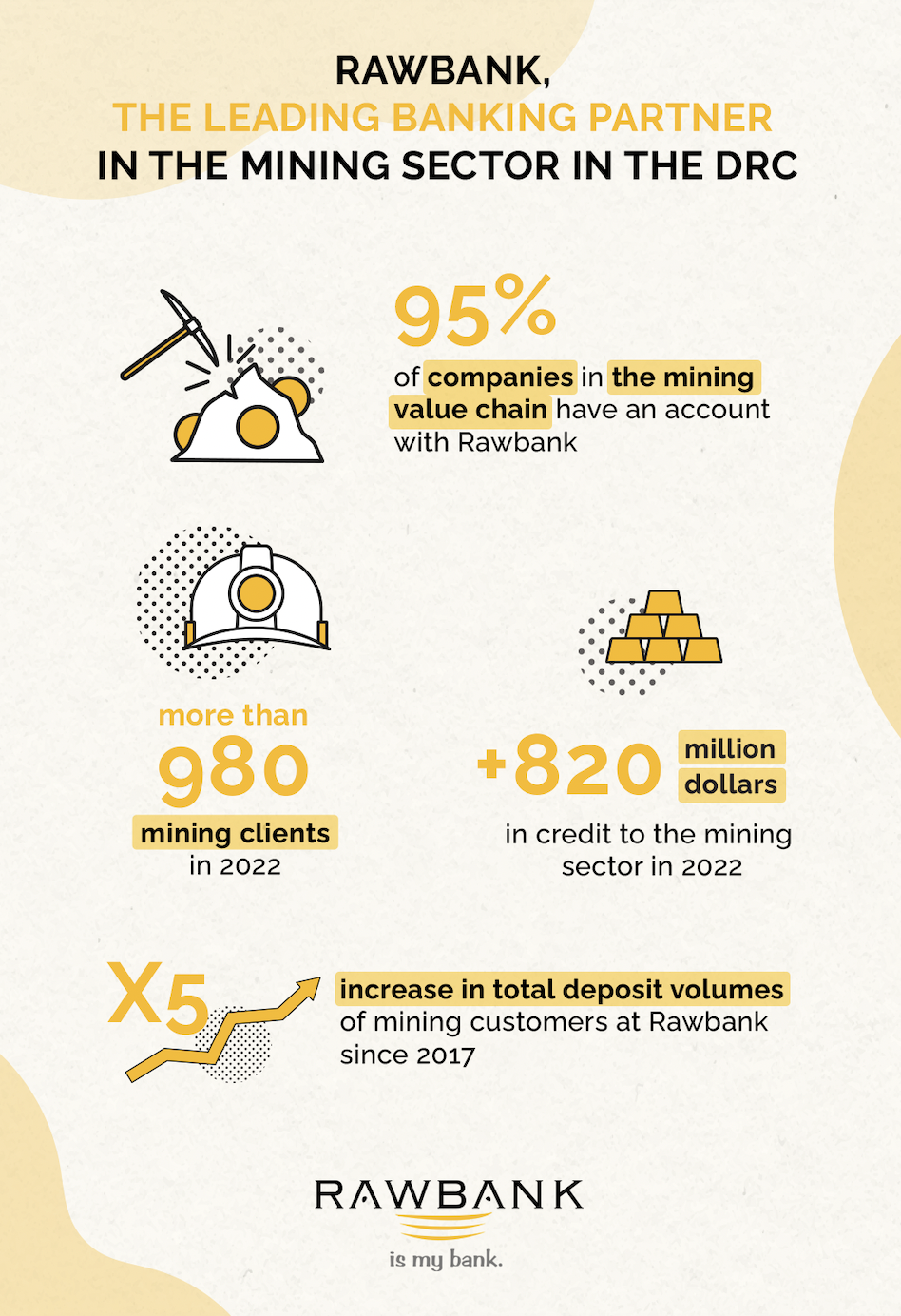

Cape Town, 10 February 2023 – Participation at the Mining Indaba Forum in Cape Town highlights Rawbank’s role as the leading partner of the mining industry and its value chain in the Democratic Republic of Congo (DRC). The bank works with 95% of the businesses in the industry to provide solutions for their financing and operational needs and to optimise their cash management.

Since it started operating in 2002, Rawbank has supplied billions of dollars of credit to mining businesses operating in the DRC. These funds have allowed more than 980 businesses in the sector to access the means to build large-scale projects in Haut Katanga and Lualaba.

The growth of this financing has played a central role in the increase in the production of copper, gold and cobalt. Financing the DRC’s economy is Rawbank’s strategic priority.

In 2022, Rawbank supplied more than $820 million of credit to international and local mining companies, including processing and production businesses in copper and cobalt. These businesses, whose activity is cash-intensive, turn to Rawbank as the bank has the necessary liquidity and expertise to evaluate and meet their credit demands (fixed-term advances, credit lines or advances on invoices or orders).

The latest statistics from the Banque Centrale du Congo (BCC) show the dynamism of the country’s extractive industries. In 2022, mining companies in the DRC produced:

- 111,309 tonnes of cobalt versus 93,144 in 2021, an increase of more than 19%;

- 2,359,824 tonnes of copper versus 1,802,897 tonnes in 2021, an increase of more than 30%;

- 17,742,000 carats of diamonds versus 12,179,000 in 2021, an increase of more than 45%.

The sector’s dynamic performance, bolstered by higher raw material prices, has led over the last five years to the total volume of deposits by mining clients with Rawbank increasing more than five-fold.

In his appearance on DRC Breakfast, the bank’s commercial director Mr. Etienne Mabunda insisted on the importance of putting in place solutions to facilitate the operations of businesses in the sector. These solutions include Optimus a secure Web platform which facilitates exchange declarations linked to import- export operations for goods, services and capital transfers. Further examples are Rawbank Online and SIOP, which allow automated management of transactions directly from an information system, without any intervention from the bank.

The decision-makers present at Mining Indaba saluted Rawbank’s recent launch of a trading room meeting international standards allowing the bank to offer one of its mining clients the oppor- tunity to meet their financing needs (on this occasion $10 million) on the local money market. The execution of this first operation allows the bank to now offer its clients an alternative source of financing.